Automating DeFi With Multi Agent Systems

Multi-chain Agentic systems is what DeFi needs right now. Abstracting the DeFi difficulty to onboard users while automating processes for the end user. This cannot be accomplished simply through chatbots that claim to be AI agents. Rather, we believe in completely automating the process with not just chatbots but true AI agents—and specifically, multi-chain AI networks, also known as AI swarms.

As DeFi complexity increases and opportunities span multiple blockchains, traditional approaches fall short. Users struggle with technical barriers, while developers face the challenge of creating intuitive experiences without sacrificing functionality. The solution lies in autonomous, interconnected AI systems that can navigate the multi-chain landscape seamlessly.

Understanding Agentic vs. Non-Agentic AI Workflows

Traditional Generative AI: The Linear Approach

Traditional generative AI, like a basic chatbot, follows a linear path—from start to finish—much like a simple essay-writing process.

User: "Help me swap tokens on Uniswap" AI: Provides step-by-step instructions and ends interaction

This linear workflow means:

- Responds to specific prompts with predetermined outputs

- Requires explicit human instructions for each action

- Cannot adjust responses based on changing conditions

- Ends interaction after providing answer

- Needs new prompt for each related task

For example, a standard AI chatbot might tell you: "To swap tokens on Uniswap, connect your wallet, select tokens, enter amount, confirm transaction." But that's where it stops—you're on your own for execution and troubleshooting.

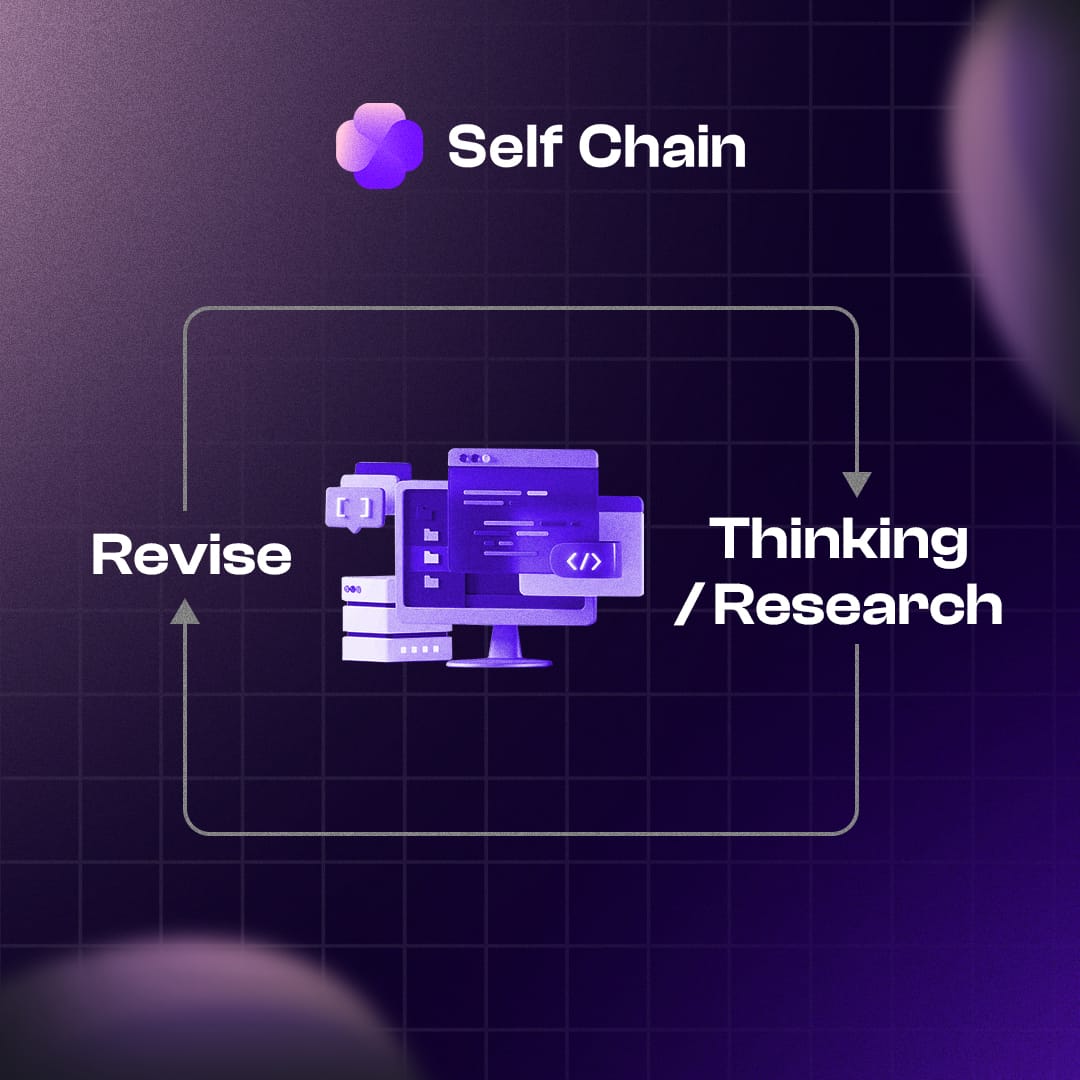

Agentic AI: The Continuous Feedback Loop

In contrast, agentic workflows operate in a continuous feedback loop, constantly:

- Thinking

- Researching

- Executing

- Revising

- Adapting

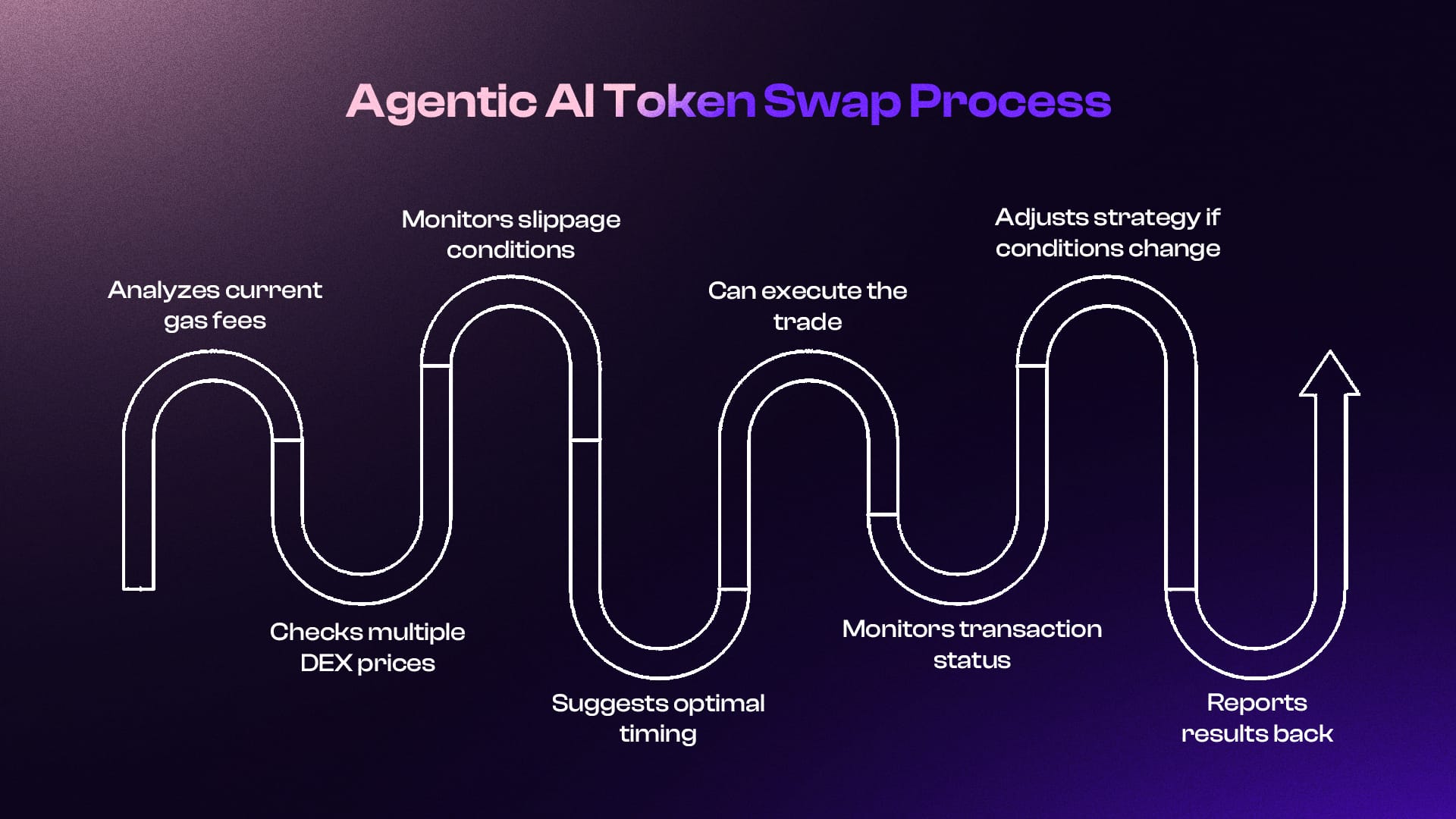

Using the same DeFi example:

User: "Help me swap tokens on Uniswap" Agentic AI:

- Analyzes current gas fees

- Checks multiple DEX prices

- Monitors slippage conditions

- Suggests optimal timing

- Can execute the trade

- Monitors transaction status

- Adjusts strategy if conditions change

- Reports results back

- Learns from the outcome for future trades

This cyclical process means the AI agent:

- Continuously monitors market conditions

- Adapts to changing circumstances

- Learns from each interaction

- Maintains engagement until goal is achieved

- Can handle complex, multi-step processes autonomously

The difference is stark: While traditional AI simply tells you what to do, agentic AI actively participates in achieving your goals through a continuous cycle of analysis, execution, and optimization.

The Power of Multi-Agent Systems: Nature's Blueprint for AI Swarms

Natural Analogies: Why Swarms Outperform Individuals

Nature provides compelling evidence for the superiority of collective intelligence:

- Ant Colonies: Individual ants follow simple rules, but collectively optimize resource gathering through pheromone-based communication. Similarly, multiple AI agents can share market insights to identify optimal trading paths.

- Bird Flocks: Birds maintain impressive formations without central coordination, adapting to environmental changes through local interactions. AI swarms similarly distribute decision-making to maintain operation even if individual nodes fail.

- Bee Colonies: Bees make collective decisions about new hive locations through a democratic process of scout reporting. AI swarms can similarly evaluate multiple strategies simultaneously and converge on optimal solutions.

Why Multi-Agent Systems Outperform Single Agents

Multi-agent systems offer several critical advantages:

- Specialization: Different agents can focus on specific tasks (market analysis, security monitoring, execution optimization), creating expertise that a generalist agent cannot match.

- Parallel Processing: Multiple agents can analyze different opportunities simultaneously, dramatically increasing the system's ability to identify and act on time-sensitive situations.

- Fault Tolerance: If one agent fails or encounters an error, others continue operating, ensuring system resilience.

- Diverse Perspectives: Multiple agents approaching problems from different angles results in more robust solutions and better risk management.

- Scalability: As complexity increases, swarm performance improves rather than degrades—the opposite of centralized systems.

Self Chain's Implementation: AI Swarms in Keyless Wallets

The Foundation: Programmable Keyless Wallets

AI AgentFi projects thrive on autonomy, flexibility, and security, making them uniquely positioned to benefit from Self Chain's modular infrastructure. Programmable keyless wallets equip AI agents with autonomous wallets powered by MPC-TSS (Multi-Party Computation with Threshold Signature Schemes) and Account Abstraction (AA), ensuring secure, decentralized operations without the need for private key management or human intervention.

The Intent SDK brings advanced intelligence to the blockchain by enabling AI agents to leverage on-chain LLMs (Large Language Models). These models empower agents to process data, execute decisions, and achieve goals autonomously. From optimizing DeFi strategies to managing complex trades, the Intent SDK equips agents with the computational intelligence necessary to outperform traditional systems.

This feature allows agents to analyze liquidity options, forecast market trends, and interact with multiple protocols to increase the potential for AgentFi opportunities, with benefits including:

- Real-time execution: Increased on-chain efficiency allows rapid, timely trades.

- Natural language skills: Robust LLMs accurately execute conversational commands.

- Data-based decisions: Give AI holistic data insights to execute beyond traditional limits.

- Optimal efficiency: Self Chain architecture automatically optimizes trades.

How It Works: The User Experience

From the user perspective, Self Chain's implementation of AI swarms creates an unprecedented level of simplicity:

- Initial Setup: Users define basic parameters like risk tolerance, investment goals, and liquidity needs.

- Swarm Activation: The system activates multiple specialized agents across relevant blockchains to monitor opportunities.

- Autonomous Operation: Multi AI operations

Agent 1 : Analyzes market conditions

Agent 2 :Executes profitable transactions

Agent 3 : Adjusts strategies based on performance

Agent 4 :Protects assets from identified risks

Agent 5 : Reports key metrics to users.

These agents work both sequentially and in parallel, adapting their coordination based on real-time conditions. For instance, while one agent executes trades, another simultaneously monitors security risks like agent 2 and agent 4 in this case. The swarm continuously self-assesses and reorganizes its workflow, sometimes also creating dynamic hierarchies that optimize for each unique situation, like multiple agents would come to submit their task to the manager agent (higher in hierarchy) to make the final decision.

- User Dashboard: Rather than managing complex operations, users interact with a simple dashboard showing performance metrics, current allocations, and high-level controls.

Conclusion: The Future of Decentralized Finance

Self Chain's implementation of multi-chain AI swarms represents a watershed moment for DeFi accessibility and performance. By abstracting away technical complexities while leveraging the power of collective AI intelligence, they've created a system that can operate autonomously across blockchain ecosystems with unprecedented efficiency.

The keyless wallet architecture eliminates the primary security risk in traditional systems while enabling true agent autonomy. Combined with on-chain LLMs and unified liquidity access, this creates an ecosystem where AI agents can truly fulfill their potential—not just assisting users, but transforming how we interact with decentralized finance entirely.

As these systems evolve, we can expect even greater advances in personalization, predictive capabilities, and cross-chain optimization. The days of manually navigating complex DeFi protocols are coming to an end. With Self Chain's AI swarm technology, the future of finance is autonomous, intelligent, and accessible to everyone—regardless of their technical expertise.

About Self Chain

Self Chain is the first Modular Intent-Centric Access Layer1 blockchain and keyless wallet infrastructure service using MPC-TSS/AA for multi-chain Web3 access. The innovative system simplifies the user experience with its intent-focused approach, using LLM to interpret user intent and discover the most efficient paths.

Self Chain ensures that onboarding and recovery are effortless with keyless wallets that grant users complete self-custody over their assets. In addition, it provides automated rewards to dApps when they efficiently resolve user intent, further enhancing the user experience. Moreover, Self Chain incorporates Account Abstraction with MPC-TSS to provide secure signing and reduce transaction fees. It's a platform that redefines blockchain interaction, making it more secure and user-friendly for everyone.